When a token is transferred from wallets to CEXs, the likely followed-up action is to sell. CEX Flow is considered an alert signal of a token’s sell pressure.

There are 2 tips for you to analyze how will the CEX Flow affect the token price.

Tip 1: Get The Real-Time CEX Deposits/Withdrawals Value

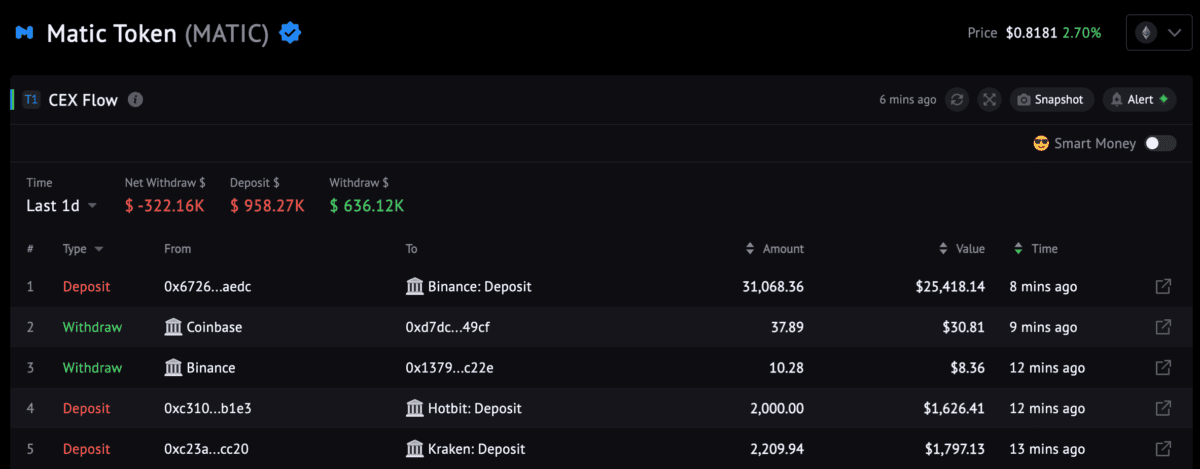

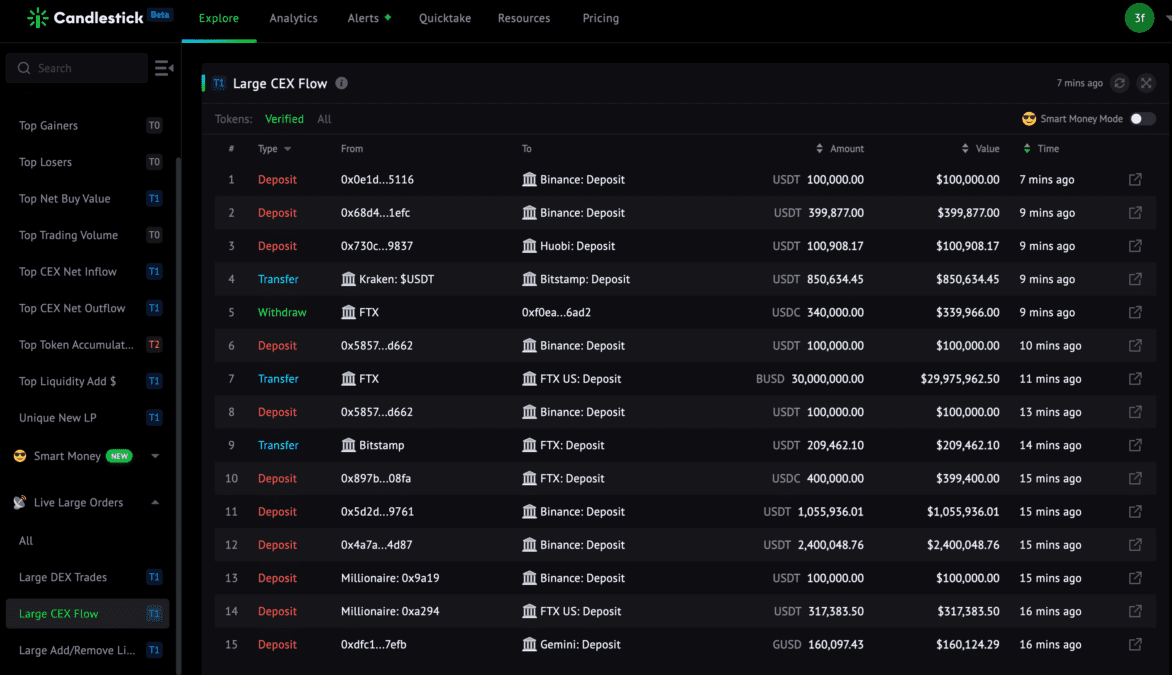

Candlestick Live Trading – CEX Flow shows the real-time CEX deposits, withdrawals, and transfers.

Steps:

- Get a picture of whether the latest flows are deposits or withdrawals

- Sort by Value. Better understanding the large value orders – deposits or withdrawals? If most of the large-value orders are deposits, be careful of the retrace.

- Change to a shorter time range to 1h and 15mins. Because large-value CEX deposits might affect the token price shortly.

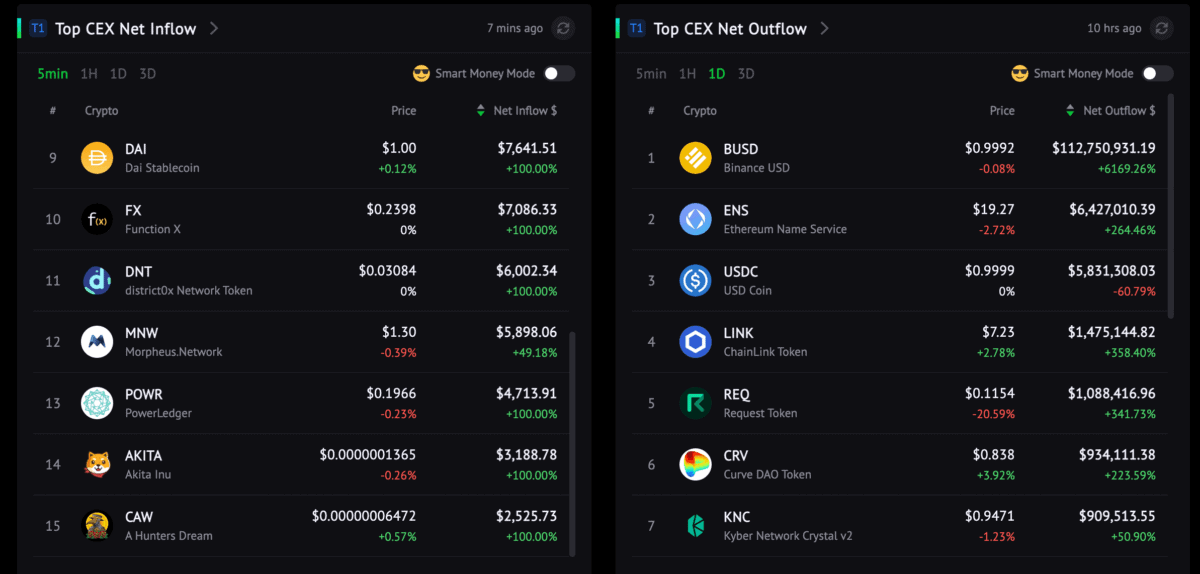

Tip 2: Net CEX Outflow Chart - Analyze The Trend and Compare With The Previous.

Candlestick Net CEX Outflow chart illustrates the value of (CEX withdrawals – CEX deposits) to give traders a full picture of the trend.

When a token gets large CEX deposits, it does not mean the price will drop immediately. You need to check the Net CEX Outflow to understand the trend.

Step 1: Compare the CEX Outflow dip with the previous.

Take $MKR for an example. The 2 deep REDs all caused the $MKR price to retrace. But comparing the 2nd one with the 1st one, the 2nd RED line is weaker than the first one, hence, you can see the price retracement is lesser.

Step 2: Monitor the ongoing CEX Outflow movements.

See the above $MKR Net CEX Outflow chart. We can see that when the 2nd RED line occurs, the line turns green and stay green for the following hours. Hence, the price retracement is lesser.

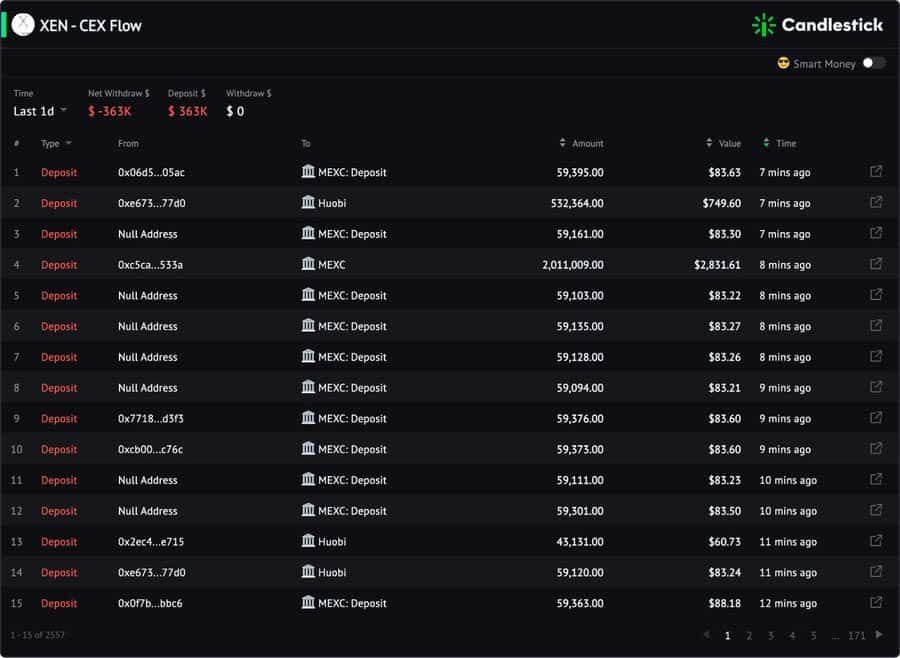

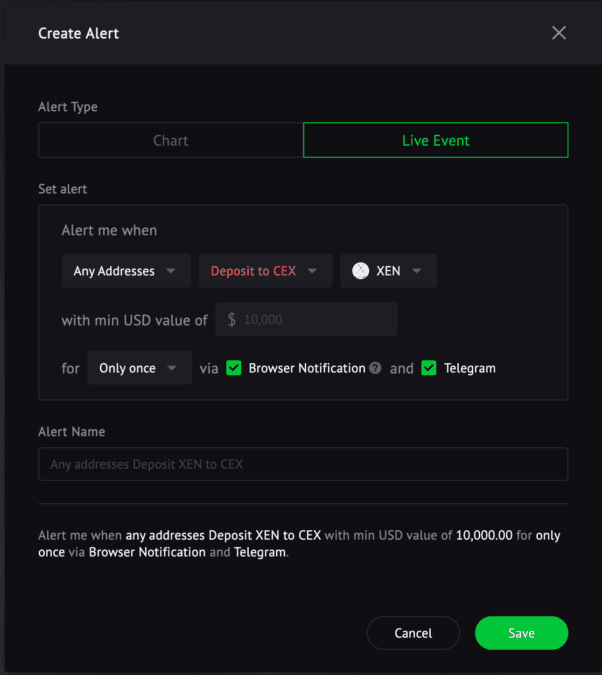

$XEN is a different case. Net CEX Outflow is negative continuously and has no signs to change. The price slumped.

This actually happened when $XEN announced its listing on Huobi. We monitored massive CEX deposits after the listing announcement. Holders are ready to sell.

Therefore, there is a saying that when a token listing on a big centralized exchange, it is time to sell. CEX Flow is very important data to monitor for a token’s new CEX listing.