Centralized Exchange (CEX) flows analytics is based on monitoring cryptos moving in and out of CEXs by analyzing on-chain transactions.

It records a money flow of a particular token transferred to and from centralized exchange wallets to evaluate investors’ behavior.

Understanding CEX Inflows/Outflows

- CEX Inflows: traders deposit tokens on CEX, more likely for selling.

- CEX Outflows: traders withdraw tokens from CEX, more likely for holding, staking, or farming.

Identify Bullish and Bearish Signals

A surge in a token’s CEX Net Inflow value indicates depositing and selling activity on CEX. Conversely, the CEX Net Outflow value increases represent buying, withdrawing, and holding.

Indicator: Top CEX Net Inflow

Formula: Tokens deposits to CEXs – Tokens withdrawals from CEXs.

Condition: An ascension in CEX Net Outflows for a particular token may indicate increasing sale activities on centralized exchanges.

Signal: Bearish

Indicator: Top CEX Net Outflow

Formula: Tokens withdrawals from CEXs – Tokens deposits to CEXs.

Condition: A rise in CEX Net Outflows for a particular token can signal increasing buy activities on centralized exchanges.

Signal: Bullish

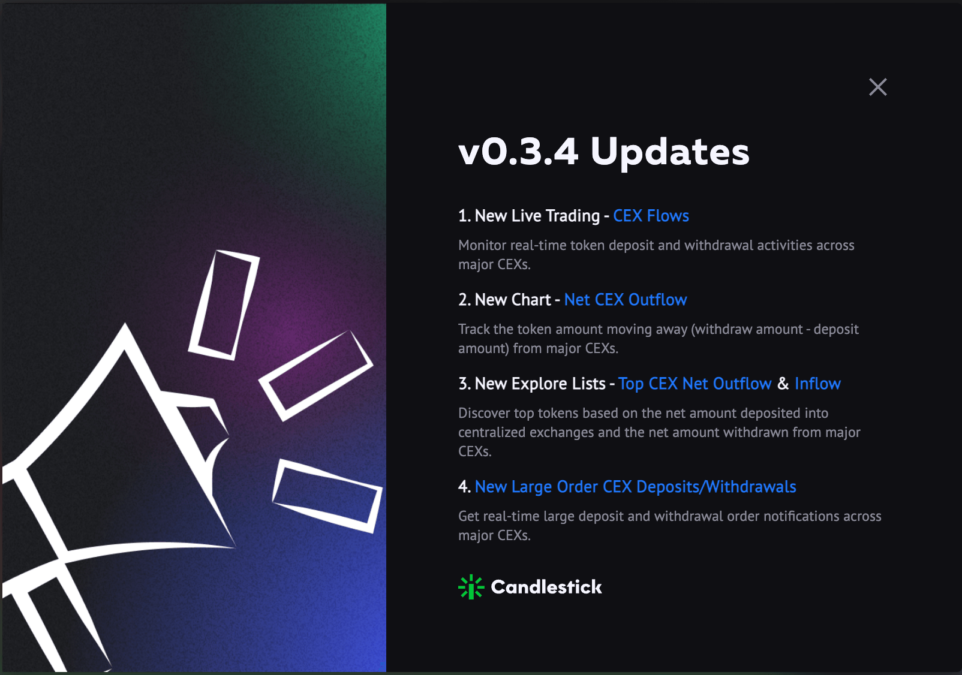

In the latest version, Candlestick has developed 4 new signals for smarter trading by token CEX flows.

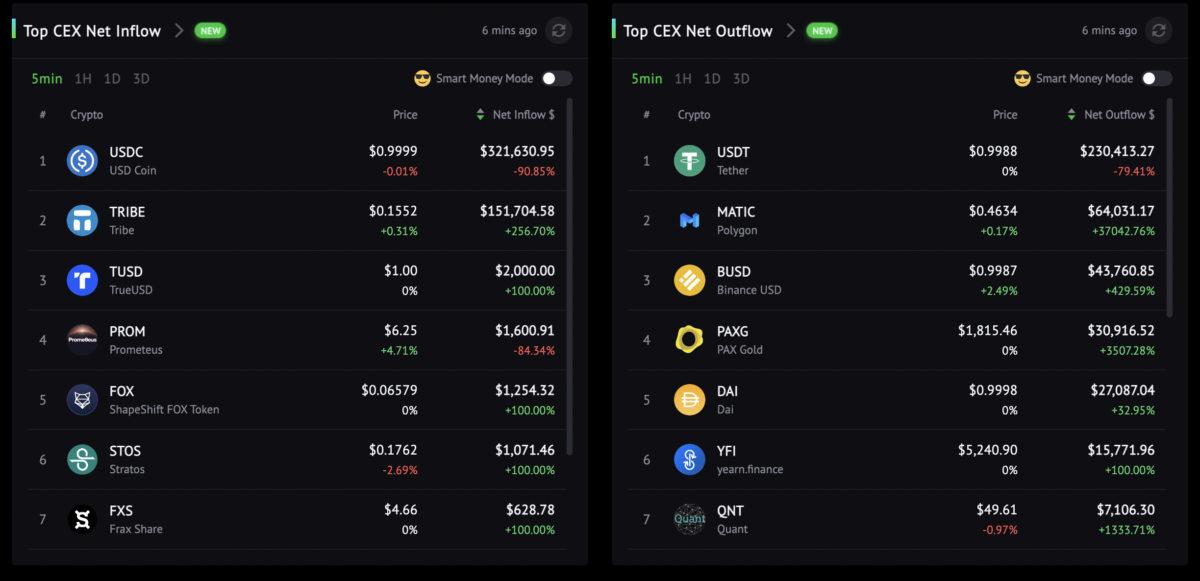

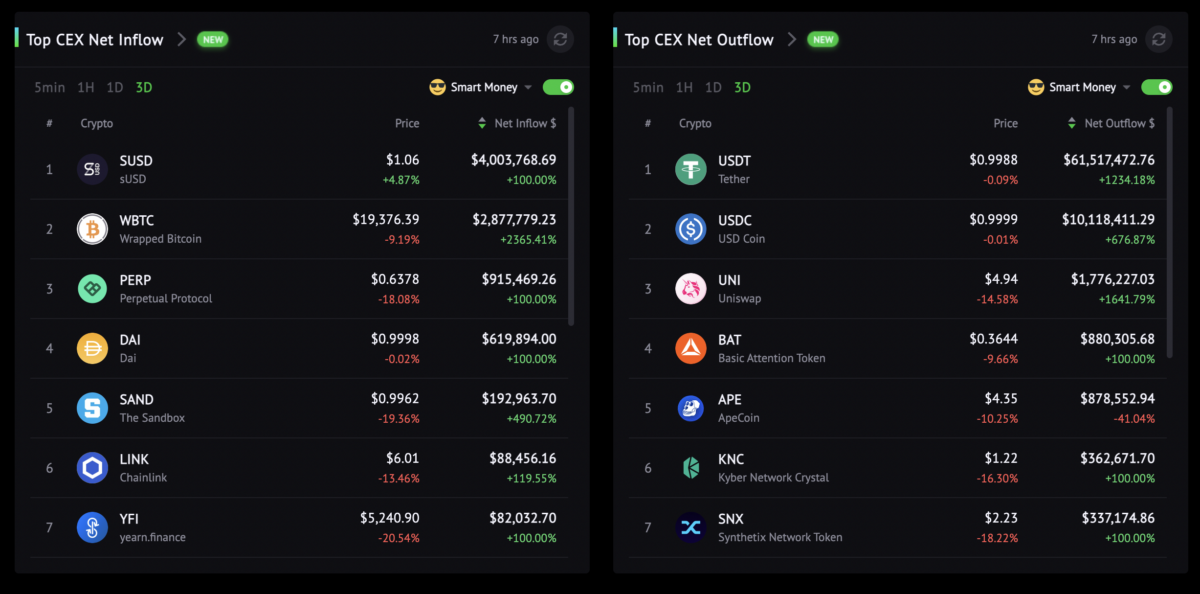

New Explore Token Lists - Top CEX Net Inflow / Top CEX Net Outflow

Two new leaderboards on the Explore page discover top tokens based on the Net CEX inflow & Outflow amounts.

These two leaderboards help you quickly monitor a token’s real-time CEX flow changes by changing the resolution of 5min, 1H, 1D & 3D. Click a target token for details.

Besides, You can check Smart Money CEX Flow activities by turning on the “Smart Money” mode.

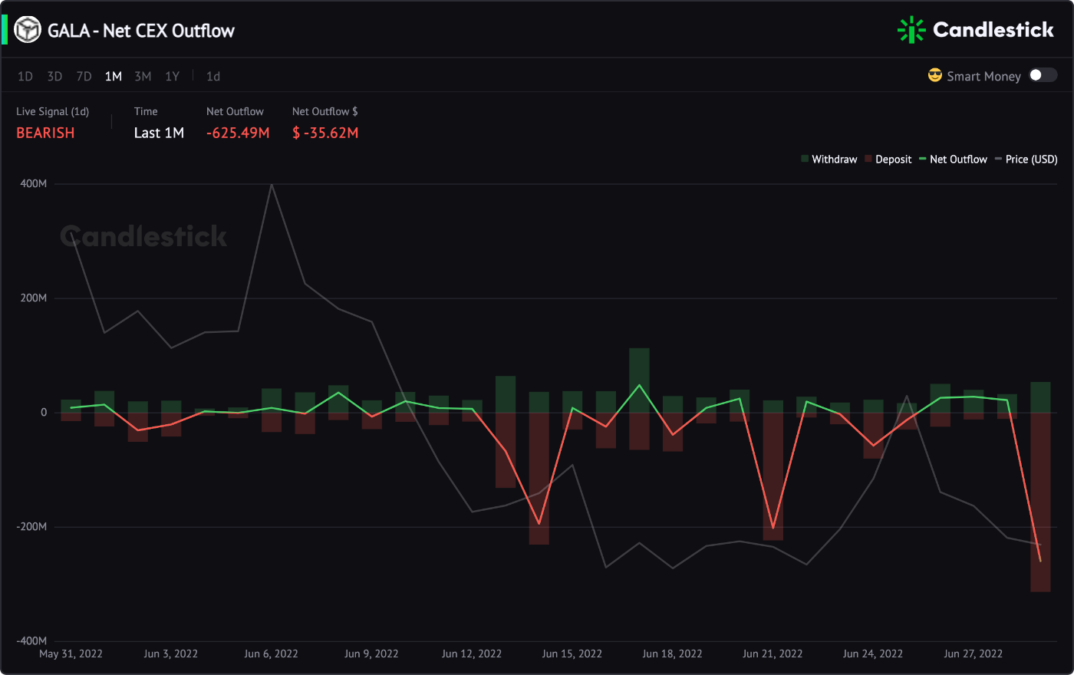

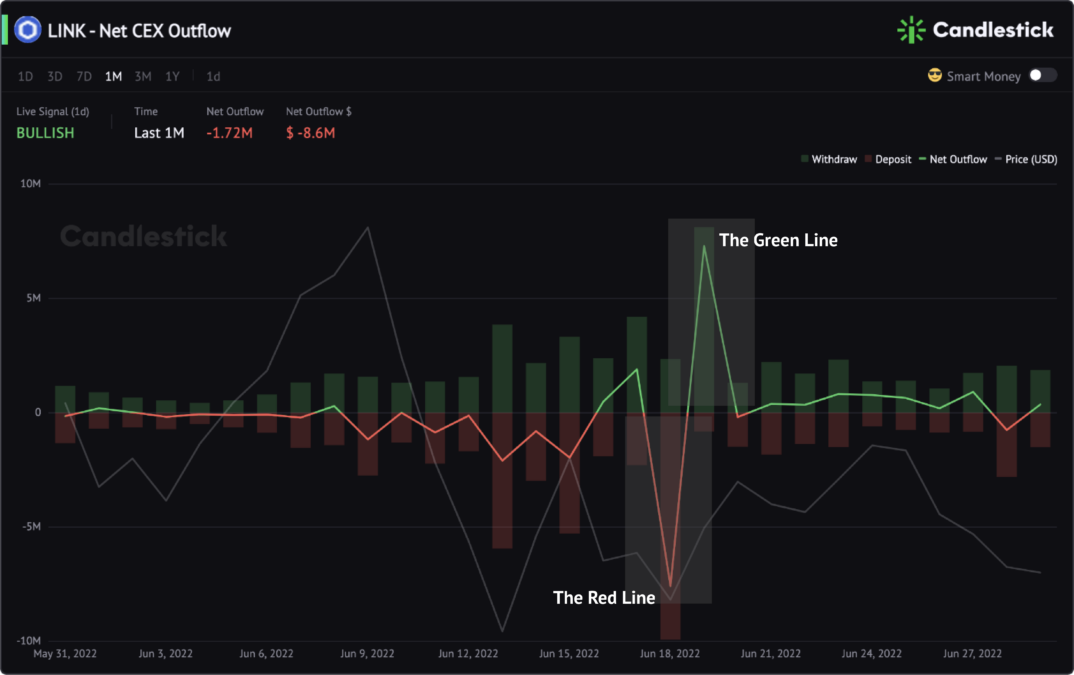

New Chart - Net CEX Outflow Indicator

The green line means the token amount withdrawals from CEX is larger than the token amount transferred into CEX, which is a bullish signal.

The red line indicates more tokens are deposited to centralized exchanges than withdrawn — a bearish signal as the followed-up action is likely to sell on CEX.

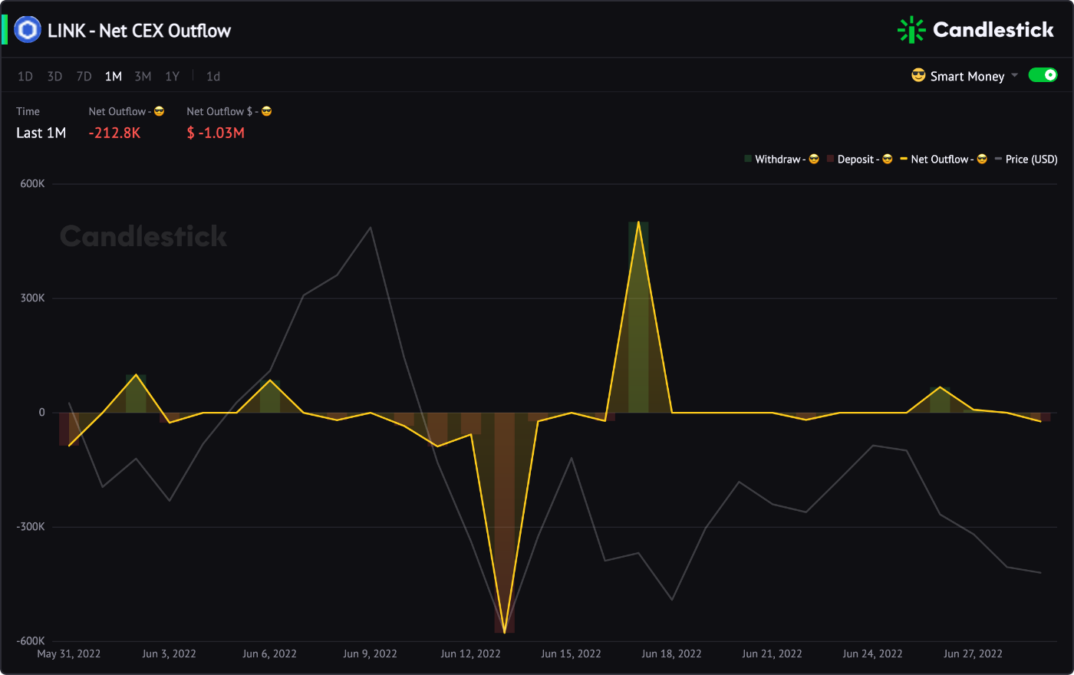

Switch to “Smart Money” mode to check Smart Money Net CEX Outflow.

For example, we observed that the $LDO Net CEX Outflow indicator was forming a negative peak at 1:00 UTC on Jun 30, then the price dropped 10% to $0.455 at 3:00 UTC.

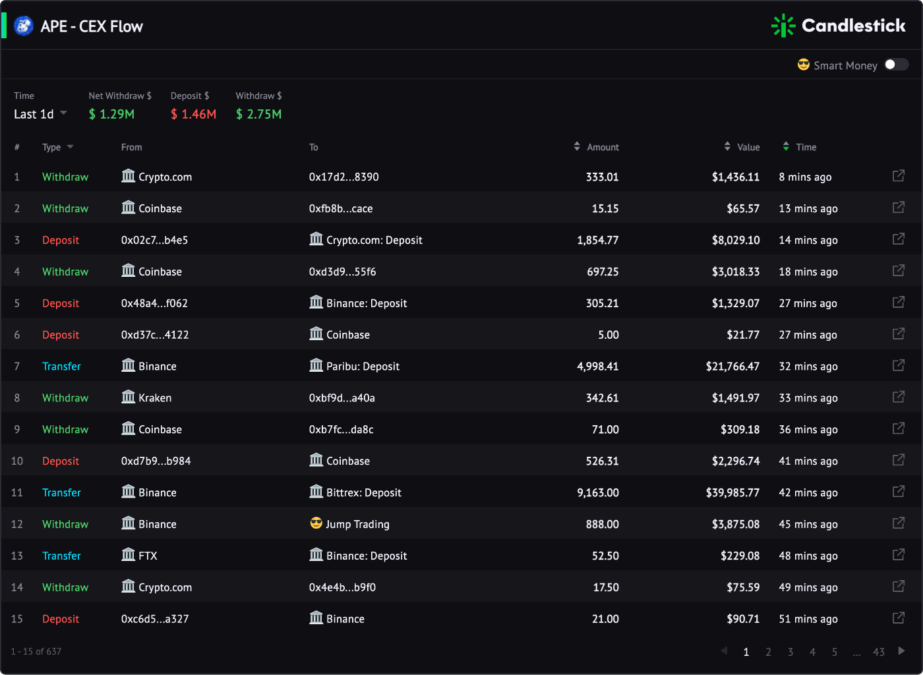

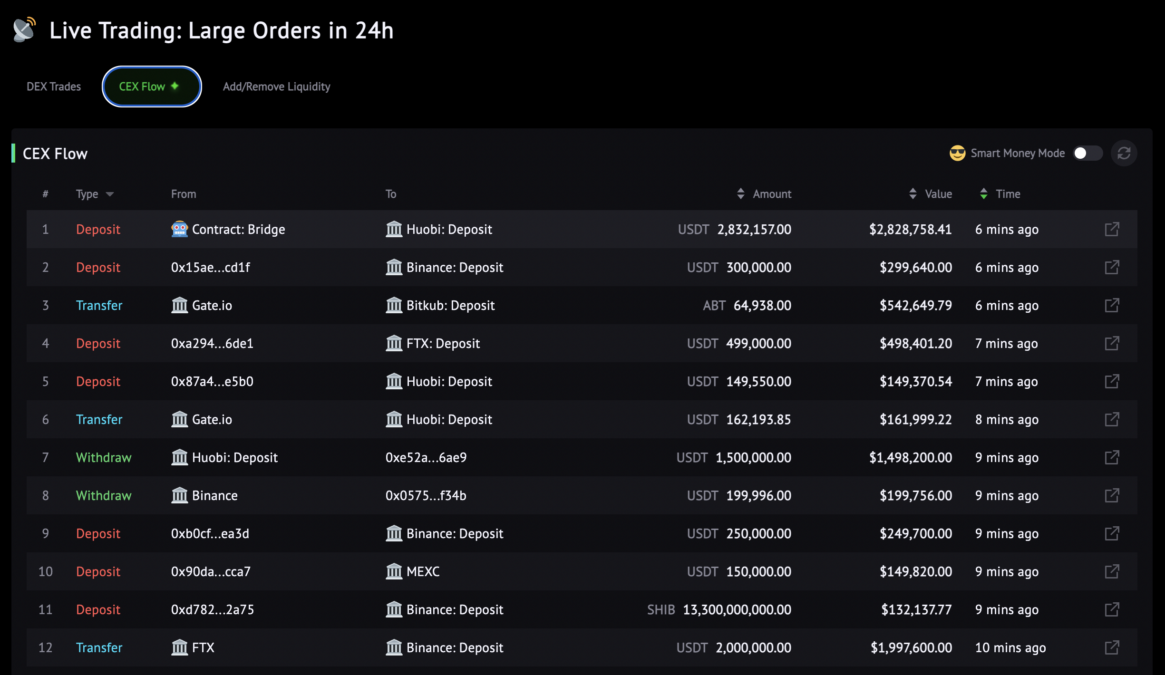

New Live Trading - Real-time CEX Flows

CEX Flows metric broadcasts real-time token deposit and withdrawal activities across major CEXs.

Combined with the Net CEX Outflow Indicator, the CEX Flows metric tracks detailed transactions to boost your crypto trading. For example, you can know who is depositing tokens into CEX.

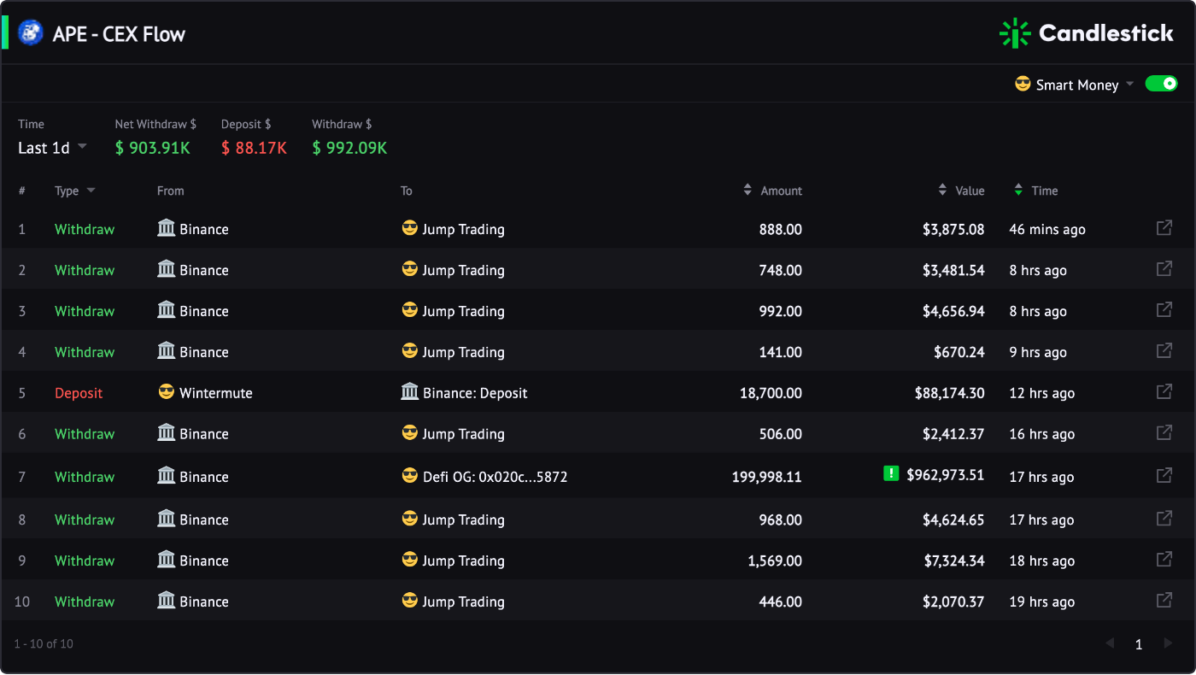

Take a sneak peek at “Smart Money” activities by turning on the “Smart Money” mode. Then you will understand whether the CEX inflows are from retail markets or smart money.

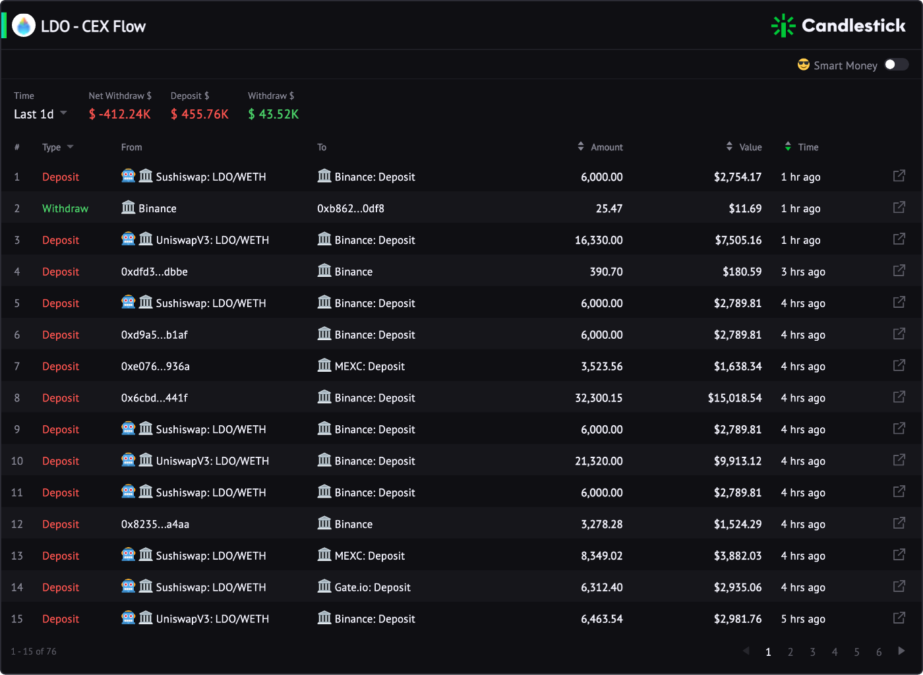

Let’s go back to the previous example. After checking $LDO CEX Flows, we noticed some individuals deposited $LDO to Binance, MEXC, Gate, etc. Over 24 hours, the deposit value was $455.76K, and there were only $43.52K withdrawals.

Get Real-Time Alerts - Large Order CEX Deposits/Withdraw

This new feed on the Explore page broadcasts real-time large deposit and withdrawal orders across major CEXs.

You can monitor live on-chain deposits and withdrawal activities that traders or smart contracts engage with top centralized exchanges.

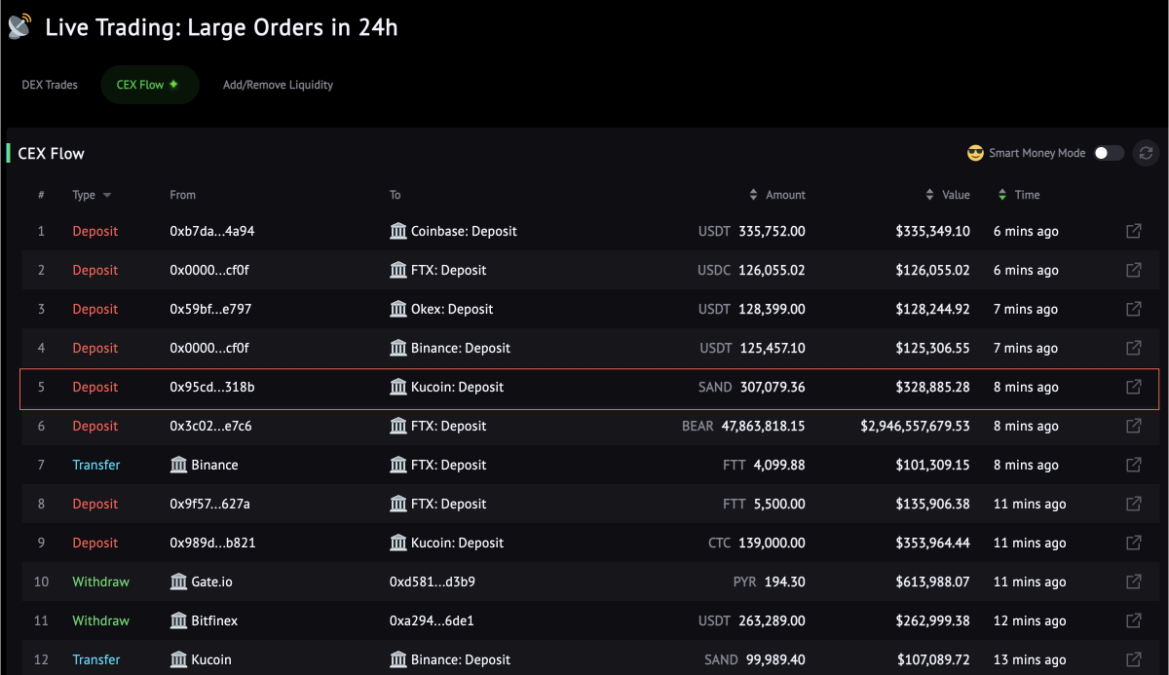

For example, in the picture below, one address deposited $328,885 Sandbox tokens to the Kucoin exchange. If you are a $SAND holder, this message will alert you to check $SAND Net CEX Outflow or $SAND CEX Flows Metric for further information.

“Smart Money” mode is also available in this metric. Click to check Smart Money Large Order CEX Deposits/Withdraw.

The Most Comprehensive CEXs Addresses Labeling

16.5M+ deposit addresses of 27 major CEXs on Ethereum:

- 5.2M from Coinbase

- 2.3M from Binance

- 1.5M from Bittrex

- MEXC

- Gate.io

- Huobi

- Kucoin

- FTX

etc

Candlestick has developed an algorithm to make CEXs addresses automatically labeled. So you won’t miss a CEX flow by being a Candlestick user.