If the Liquidity Net Add data remains positive during a price rise, the possibility of the price uptrend continuing is higher. Because it indicates that the LPs believe the price will go up further and the trading activities will remain active so that they can earn the trading fees as an LP.

Tip 1 - If Liquidity Net Add turns negative during a price uptrend, a signal of subsequent price retrace.

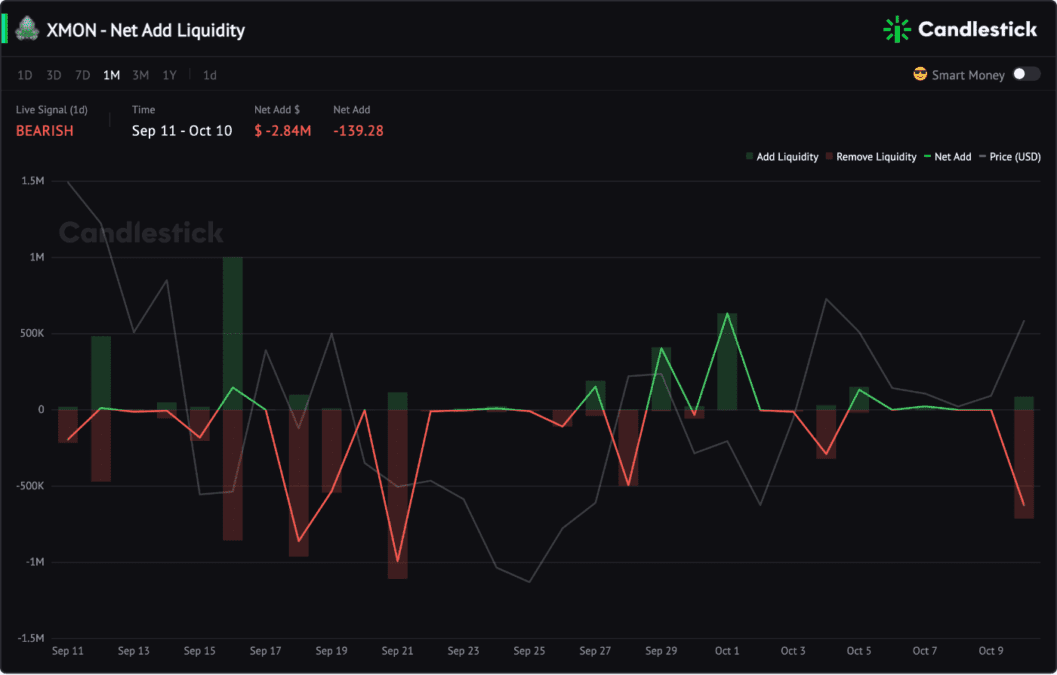

Take XMON as an example. Yesterday, when XMON was up 20%, we alerted the subsequent price retrace on Twitter as the Net Add Liquidity indicator showed negative during the price up.

We can see from the above chart, in the past 1 month, when Liquidity Net Add is negative during the price up, it will have a follow-up price retrace.

XMON dropped 13% today. (Oct 12)

The logic of the Liquidity Net Add signal is not hard to get. With more liquidity removal, more tokens are back in the market to sell, and vice versa.

Tip 2 - If the Liquidity Net Add remains positive during a price uptrend, a good chance that the uptrend is sustainable

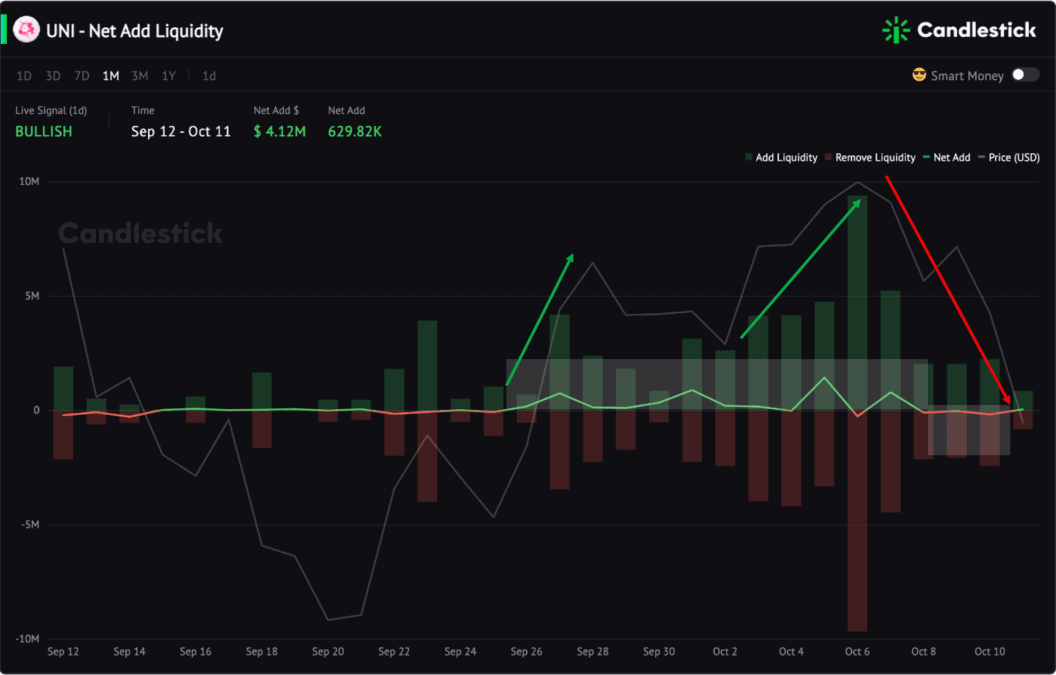

Take UNI as an example.

When the price uptrend started on September 26, the Net Add Liquidity metric remained positive. The UNI price is up from $5.91 to $6.87.

When it hit the 1-month-high at $6.87, the Net Add Liquidity signal turns RED. It then went into a price retrace to below $6 till now.