Your tea may not be mine.

For instance, you might chase degen new token opportunity while I prefer trading verified tokens; you could be a full-time crypto trader whereas I might only have a few hours each week in trading.

There’s no ‘better’ strategy—only what’s more suitable for each of us.

The 5 key elements to check the address's profitability metrics to match his trading strategy with yours:

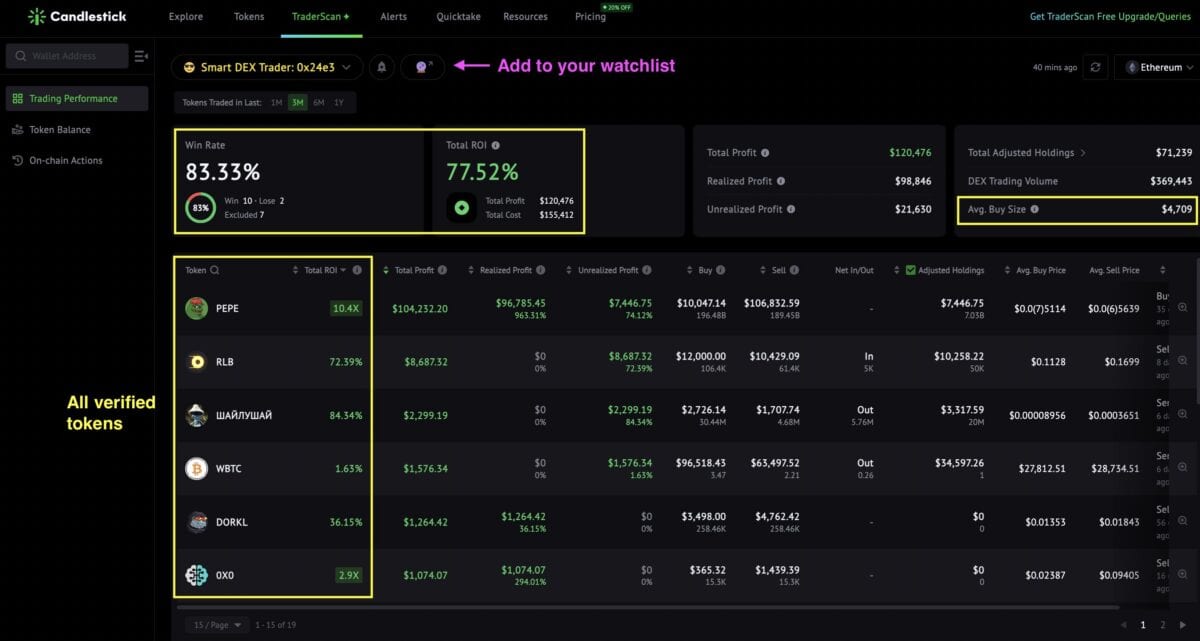

If you’re a low-frequency crypto trader with money (🤣), you’ll like this 😎address 0x24e3.

The 5 key elements to check the address’s profitability metrics to match his trading strategy with yours:

1. Low frequency: Only traded 12 tokens in the last 3 months

2. Win in 10 tokens – 83% Win Rate.

3. A $155,412 initial investment to gain $120,476 pure profit to date – 77.52% Total ROI.

4. Relatively larger ticket size trader – avg buy size $4,709. – that’s why he gained this decent profit.

5. Not a high-risk for a high-profit seeker – most of the tokens he traded are verified tokens.

–> he might be your tea

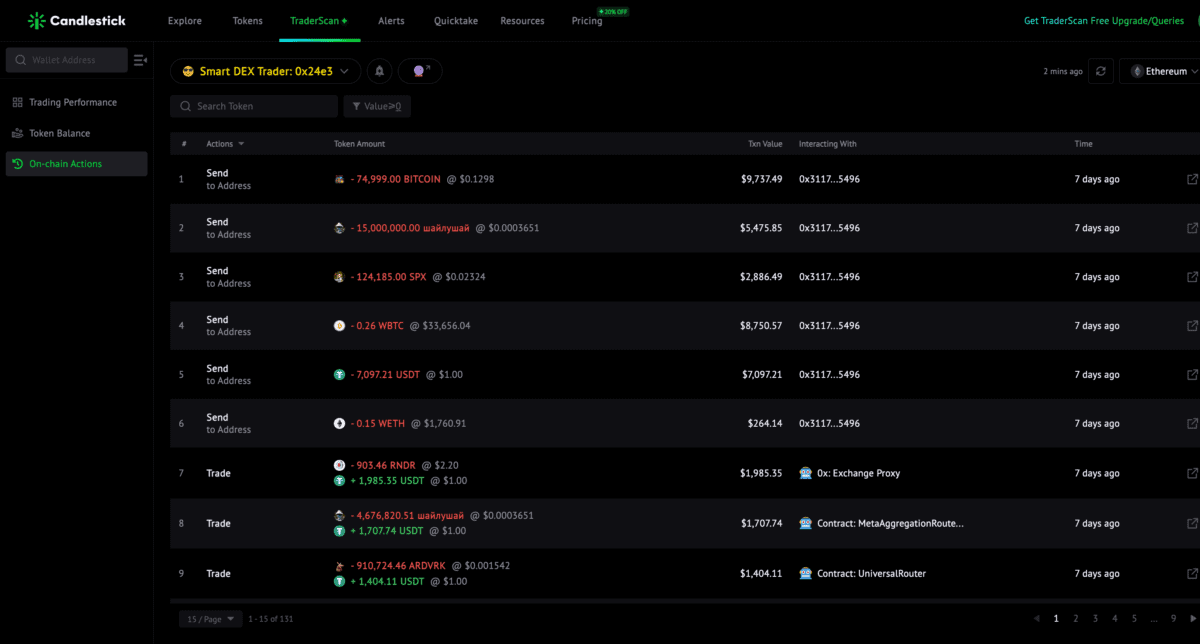

And we found his associated address via ‘On-chain Actions’ tab

–>