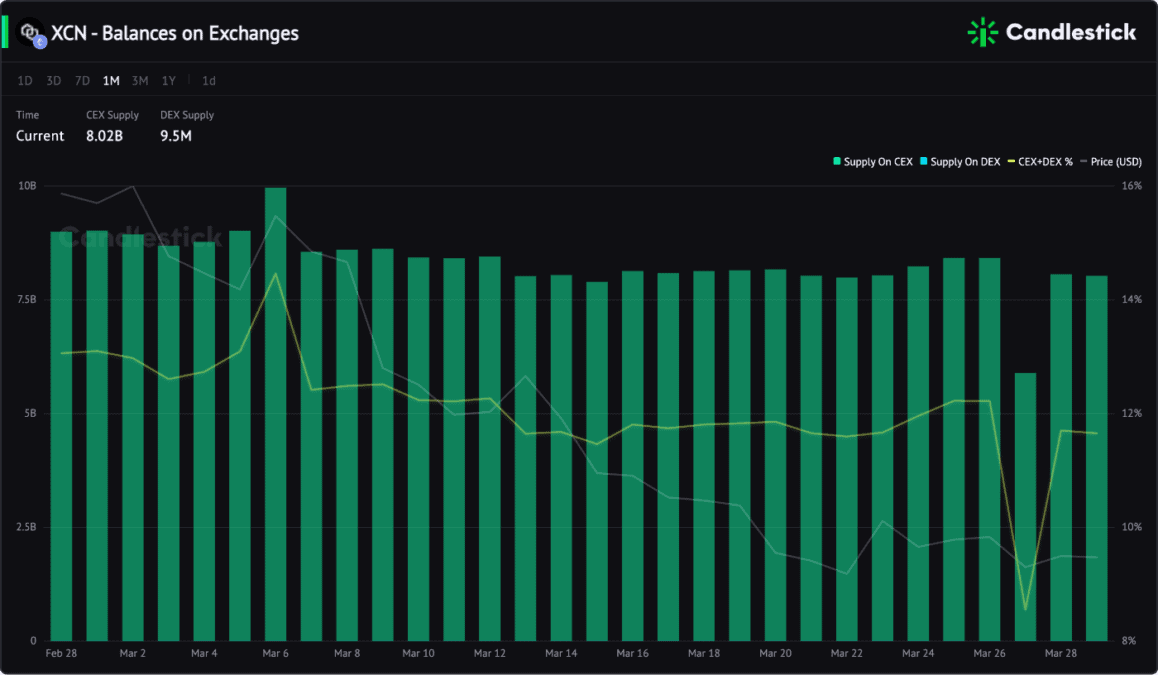

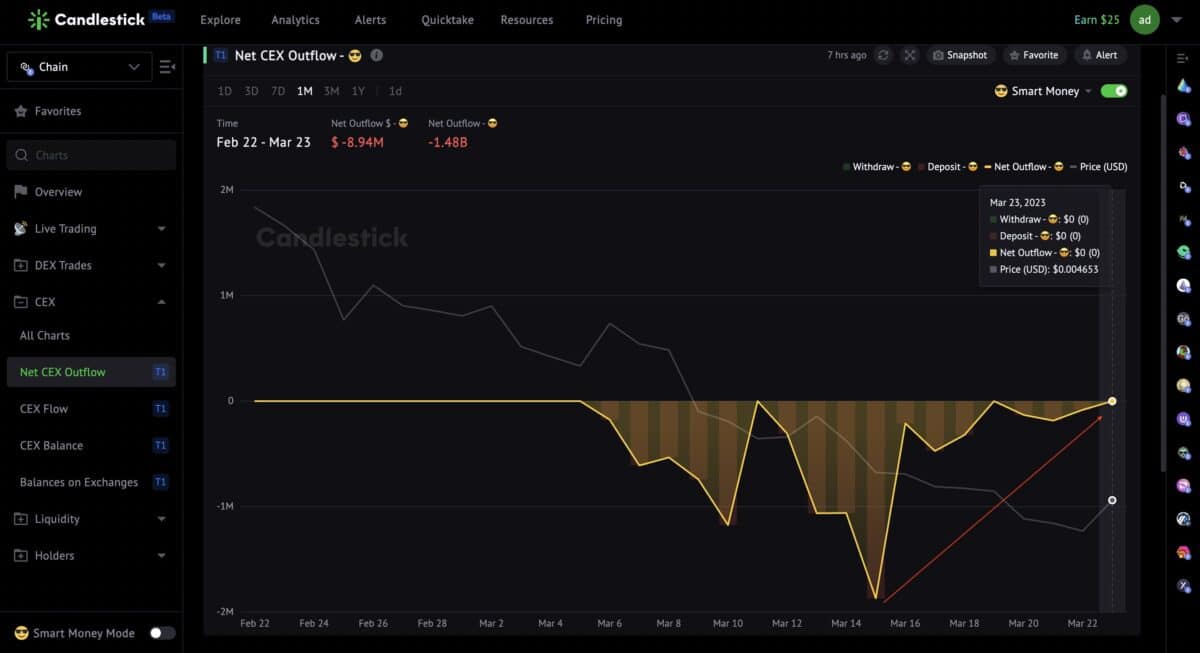

$XCN is a token primarily circulated on centralized exchanges, with a CEX supply of 8.02 billion.

Therefore, the relationship between CEX-related charts and the price is more closely linked.

CEX Deposits Suppressed Price Up

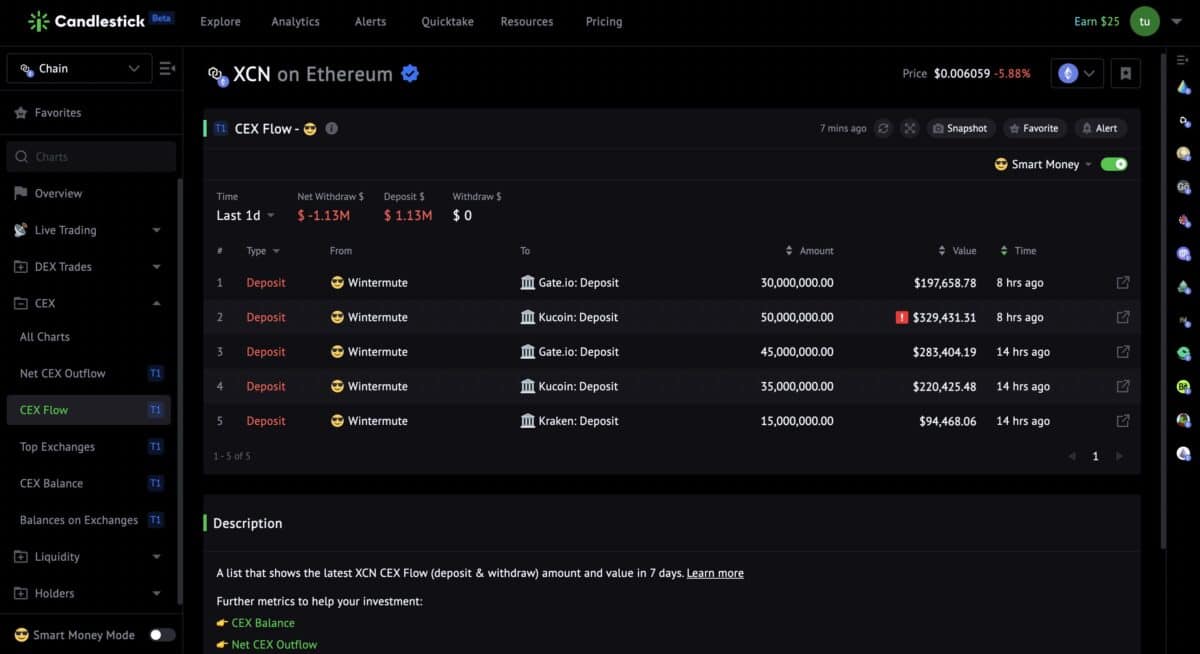

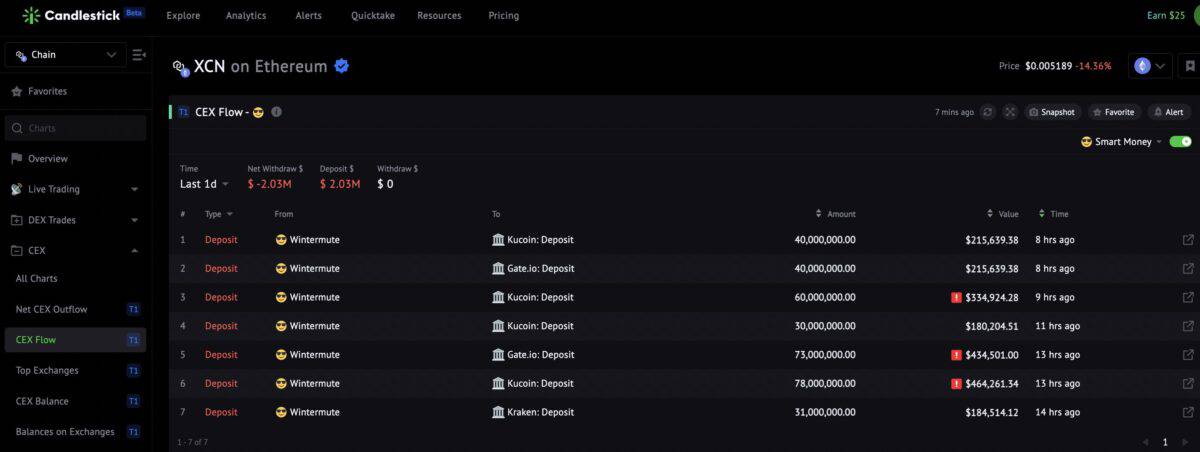

In contrast to typical market maker behavior, Wintermute had been continuously depositing XCN tokens to centralized exchanges without any withdrawal activity between Mar 6 and Mar 22.

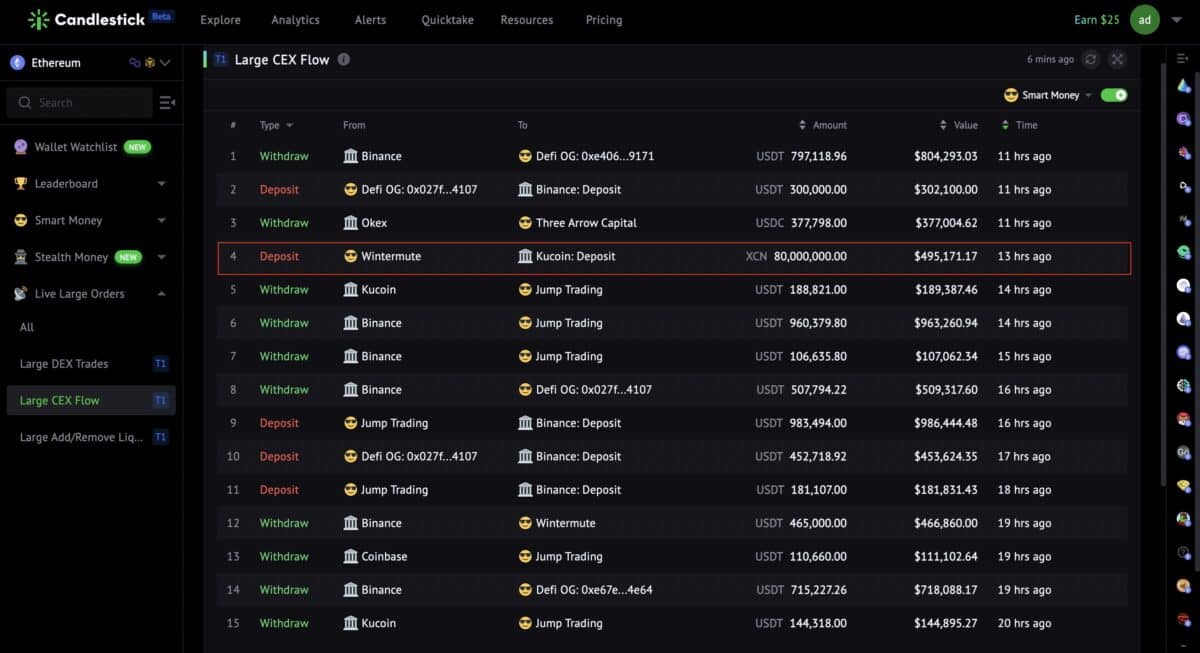

For example, on Mar 14, they deposited $495K $XCN to Kucoin.

On Mar 15, the deposit trend continued. In 24h, Wintermute deposited $1.13M $XCN to CEXs.

On Mar 16, a total of $2.03M $XCN was deposited to Gateio and KuCoin by Wintermute.

The Net CEX Outflow shows the suppressive effect of sustained large CEX deposits on the price due to selling pressure.

The Price Rebounded After CEX Deposits Ceased

On Mar 24, the $XCN price finally recovered 17% in 24h.

Looking back at the case of $XCN, we can see that its price rebounded after the selling pressure caused by CEX deposits decreased.

Why Track CEX Flow: Understanding Its Importance In Crypto Trading

When tokens are transferred from wallets to CEXs, the likely followed-up action is to sell. Therefore, CEX Flow is an alert signal of a token’s sell pressure.

We’ve developed comprehensive indicators for monitoring CEX inflows and outflows.