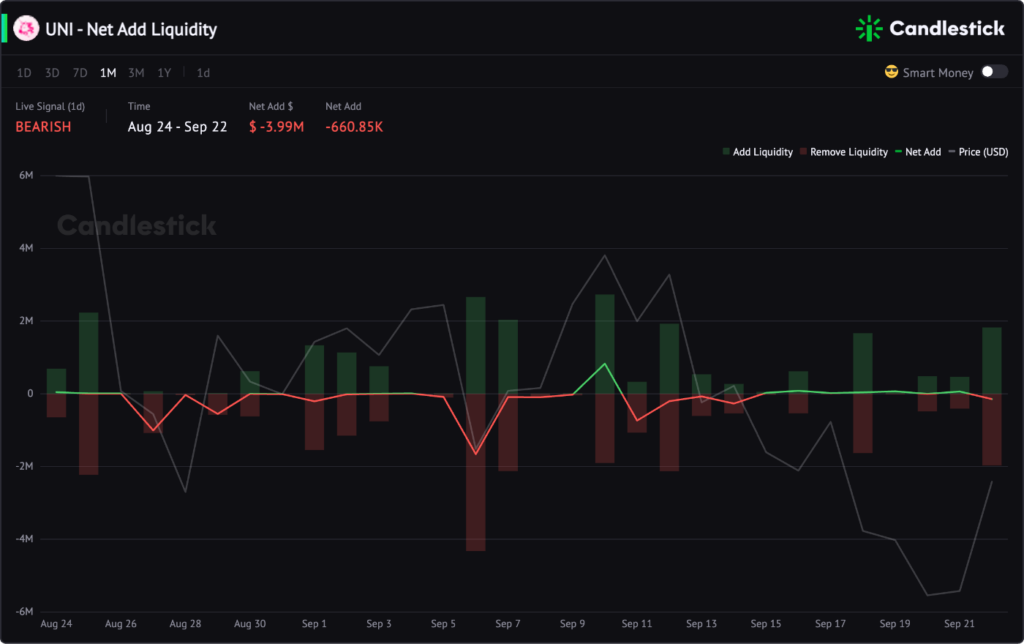

This article introduces the Net Add Liquidity and how to capture bullish and bearish signals via this metric.

Definition

The Net Add Liquidity refers to the net number of particular tokens deposited in liquidity pools in decentralized exchanges (DEXs).

The net add amount equals the added amount of a particular token minus the removed amount. This number could be positive or negative.

[latexpage]

\[Net\ Add\ liquidity = Add\ Liquidity\ Value-Remove\ Liquidity\ Value\]

For instance, suppose $1,000 worth of examplecoins are added to liquidity pools in DEX, and $500 are removed simultaneously. Then, the Net add liquidity will be 500 (1,000-500=500).

How can I use it?

DEXs allow traders to become liquidity providers for different trading pairs. In return, LPs will receive the trading pairs’ fee rewards according to their share of the pool.

In general, adding liquidity is an optimistic traders’ action as LPs are putting tokens to the trading pairs for future returns instead of selling. Additionally, LPs believe that more traders will trade with this token and generate more trading fees.

Identify bullish and bearish signals

The change in Net Add Liquidity presumably signals the sentiment of traders.

| Metric | Condition | Signal |

| Net add liquidity | >0 | Bullish |

More tokens are provided into the pool to increase liquidity.

People are optimistic about the long-term valuation of this token, and they think the token transaction on DEXs will be active and will enjoy the revenue generated. Hence, the price will be less likely to drop.

| Metric | Condition | Signal |

| Net add liquidity | <0 | Bearish |

More tokens are removed from the liquidity pool.

In general, people are withdrawing tokens in the market. As a result, the token’s trading pairs have less liquidity on DEXs. In addition, after withdrawal, they may tend to swap the tokens to other assets. Thus, the price will be more likely to drop.