Quick Take

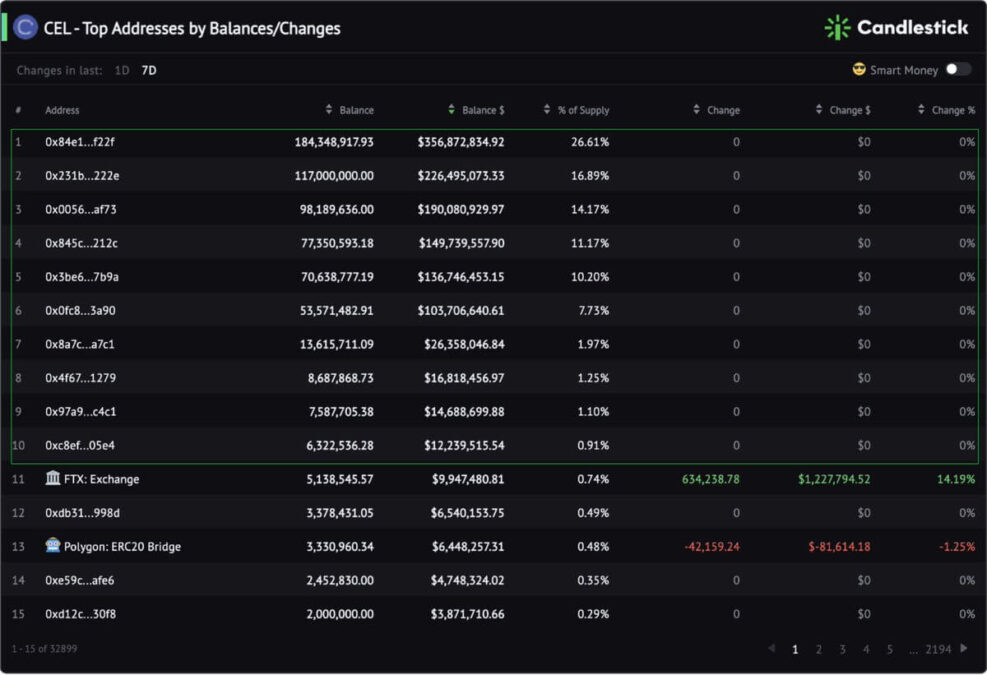

CEL - How did the top holders react to the CelShortSqueeze?

The balances of the top 10 CEL addresses have not changed in the past 7 days.

Switch to Smart Money to understand how did these whales reacting.

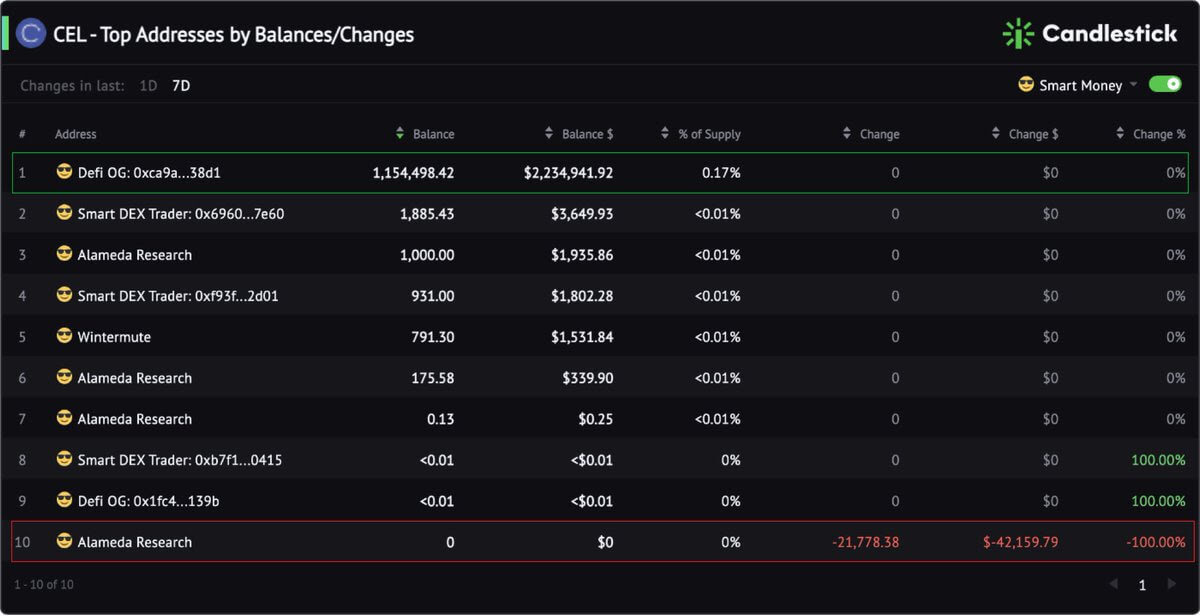

– Alameda Research sold $42K worth of CEL tokens.

– Defi OG 0xca9a…38d1 still hold $2,234,941 CEL.

Candlestick tracks algorithm-selected Smart Money addresses & also 1608 Debank Tops addresses. Switch to Debank Tops to check.

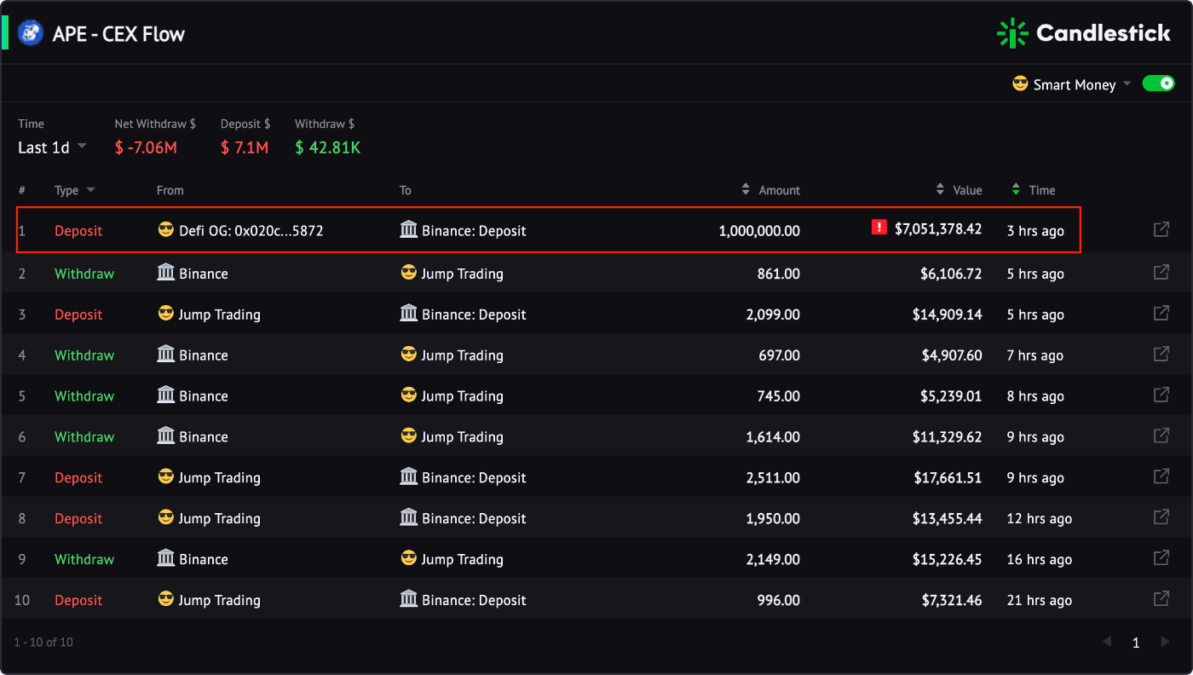

APE - DeFi OG deposited 1M APE (worth $7M) to Binance.

A large amount of token deposited to CEXs is a very important signal for traders to sense the risk of potential followed-up token sell.

APE price dropped 5% immediately after this large CEX deposit.

Why? Traders deposit tokens to CEX, more likely for selling. And usually, the large the token amount to sell, the higher possibility they will transfer to CEXs to sell to avoid the price slipage of selling on DEXs.

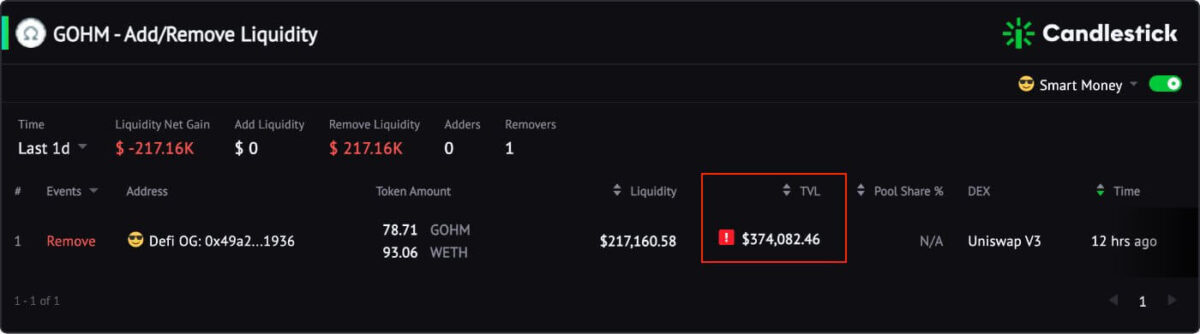

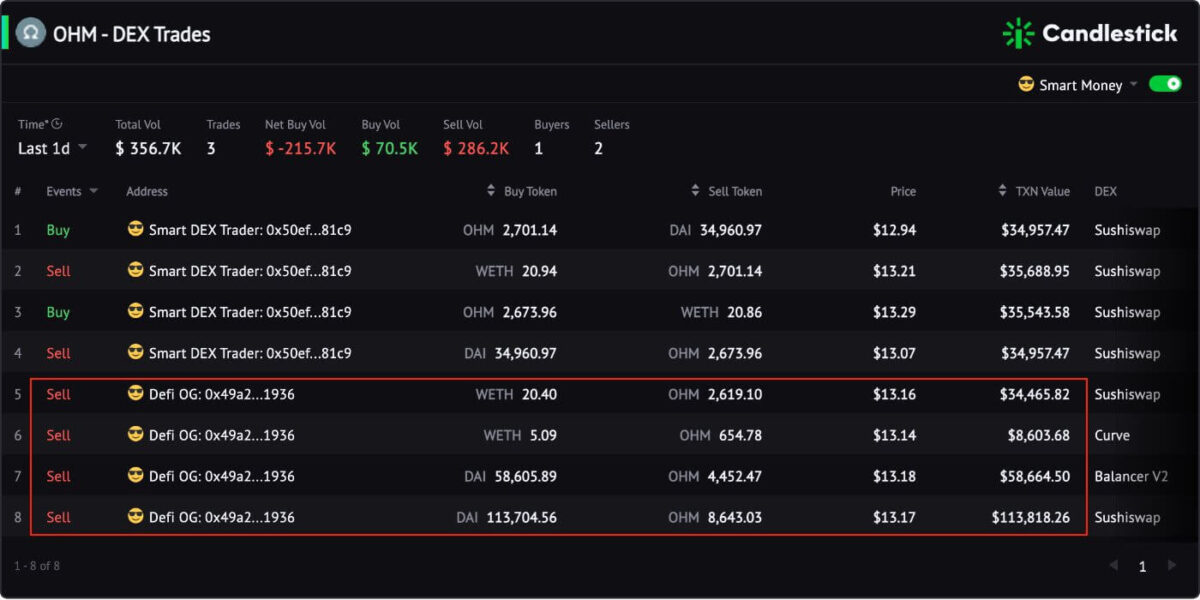

OHM - DeFi OG Removed Liquidity and Sold

Follow the smarter ones.

It works on both finding a GEM that smart money are in to capture the uptrend and also to alert you of the potential risk when the smart money have some negative actions – eg, remove liquidities, sell large volume, etc.

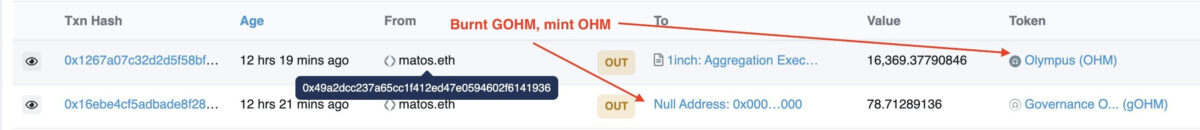

This DeFi OG removed $374k GOHM liquidity.

He then sent all the GOHM to null address to burnt and mint the same value of OHM.

After he received the OHM, he sold all OHM on Sushiswap, Curve & Balancer at $13.17 via 1inch. The price dropped to $12 after that.

Seems complicated to monitor the whole chain? Not really. You just need to monitor the OHM Smart money DEX Trades & GOHM liquidity movement to get a notice of the potential risk.

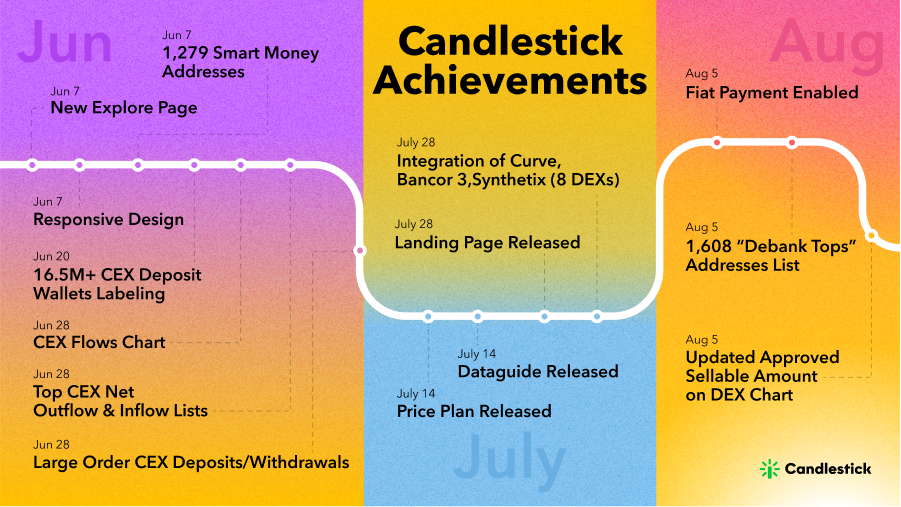

Shipped by Candlestick Express, Last 2 months:

Smart Money

– 1,279 Defi OGs & traders

– 1,608 Debank Tops

CEX Tracking

– 16.5M+ Wallets of 27 CEXs

ALL DEXs Covered

– Exclusivly Curve, Bancor etc.