What is TerraUSD (UST)?

TerraUSD is a native algorithmic stablecoin running on the Terra Luna network that maintains a $1 peg.

On May 10, 2022, UST lost its dollar peg and caused a continuous crypto market crash.

After a week of slumping, on May 13, Luna was down to 99.95%, and UST dropped 86.91%.

Candlestick indicators recorded significant bearish signals of UST before the more wide crash happened.

UST Net Add Amount for Liquidity

Liquidity withdrawal always happens before price slumps.

We noticed that the Net Add Amount for Liquidity indicator had been negative since May 6. Liquidity providers removed UST liquidity for three days, indicating a continuing lack of confidence. As a result, the net add amount and the price dropped together.

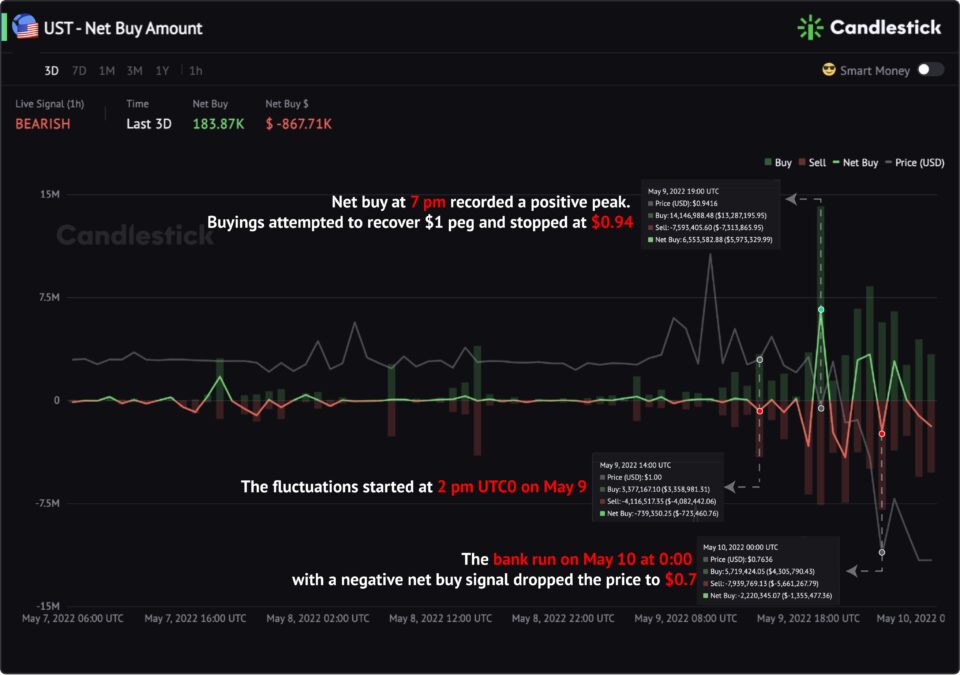

UST Net Buy Amount

Net Buy Amount shows that the fluctuations started at 2 pm UTC0 on May 9. Although the net buy at 7 pm recorded a positive peak where buyings of Luna Foundation Guard attempted to recover $1 peg, the price stopped at $0.94.

The bank run on May 10 at 0:00 with a negative net buy signal dropped the price even lower.

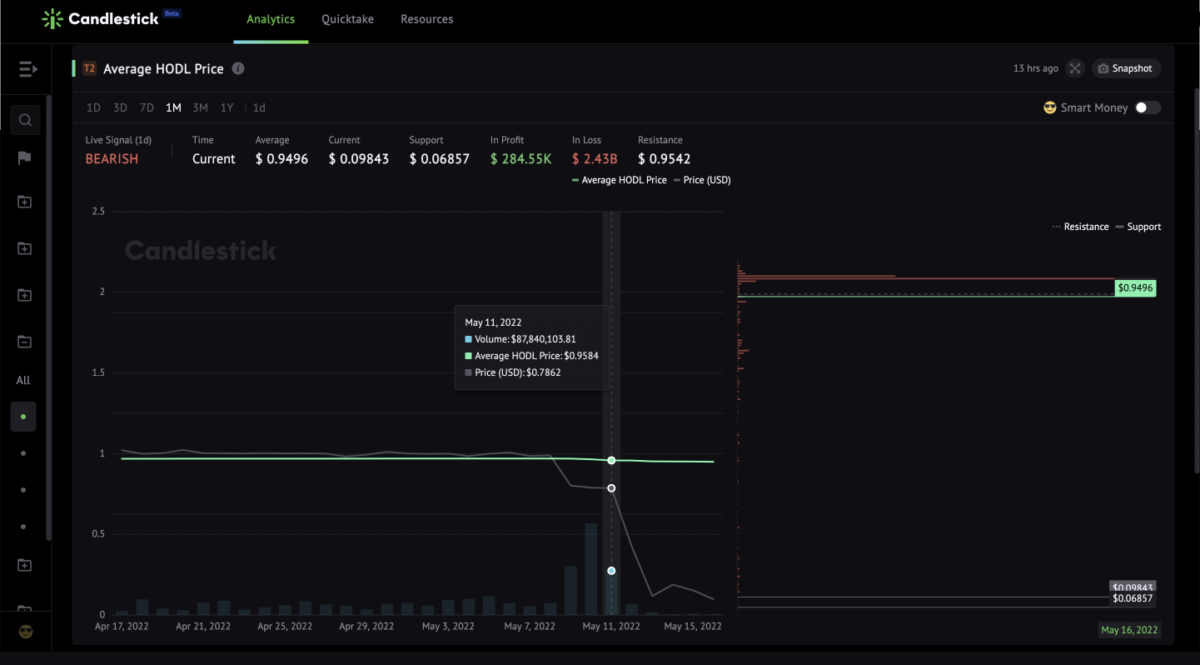

UST Average HOLD Price

On May 9, the price fell below the average HOLD Price, falling to $0.8 with an increase of $97M in trading volume. Luna Foundation Guard implemented several actions to stop the downward, leading to an $85M volume increase on May 10.

On May 11, the price got entirely out of control, and UST began to slump.