Quick Take

- Candlestick alerted our users of 3 risks on Twitter when the SHIB price was up 20%+ to $0.00001695 on Aug 14. SHIB experienced a price retrace after that.

- Applying the same logic, these 3 metrics are turning positive – CEX Flow, Net Add Liquidity & Approved Sellable Amount on DEX.

- Monitor SHIB burnt vs SHIB staked.

When trading SHIB, 3 critical metrics you must keep track of to understand traders’ sentiment better – CEX Flow, Net Add Liquidity & Approved Sellable Amount.

These 3 signals are very practical during price skyrocketing or plunges. You can use these three metrics to understand the traders’ reactions when facing the SHIB price fluctuations.

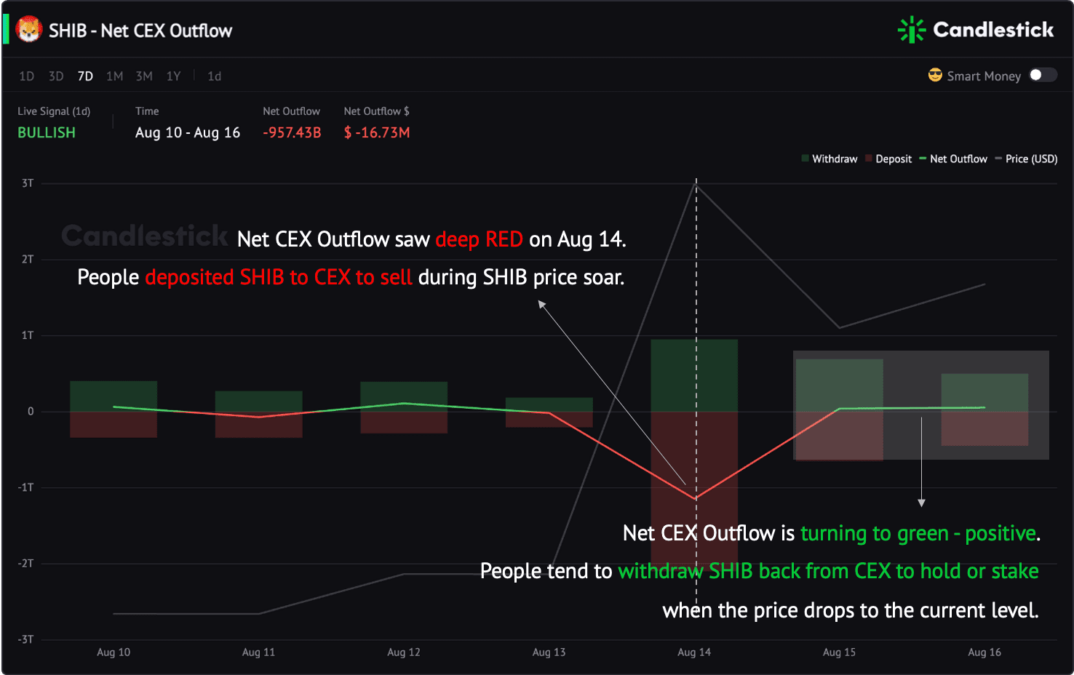

SHIB CEX Flow: What Has Changed?

When tokens are deposited to CEXs, it is more likely to sell. Because on CEXs, traders get lesser price slippage.

The chart clearly shows that when the SHIB price was up from $0.00001271 to $0.00001695, the rising price triggered people to transfer SHIB to CEXs to sell.

Hence, it indicated that traders tend to sell SHIB when the price soar to $0.00001695.

What Has Changed?

On Aug 15 & 16, SHIB price retraced back to $0.0001539, and CEX flow started to turn positive. It indicates that people tend to withdraw SHIB tokens back to wallets to hold or DEX pools to stake instead of selling at the current price.

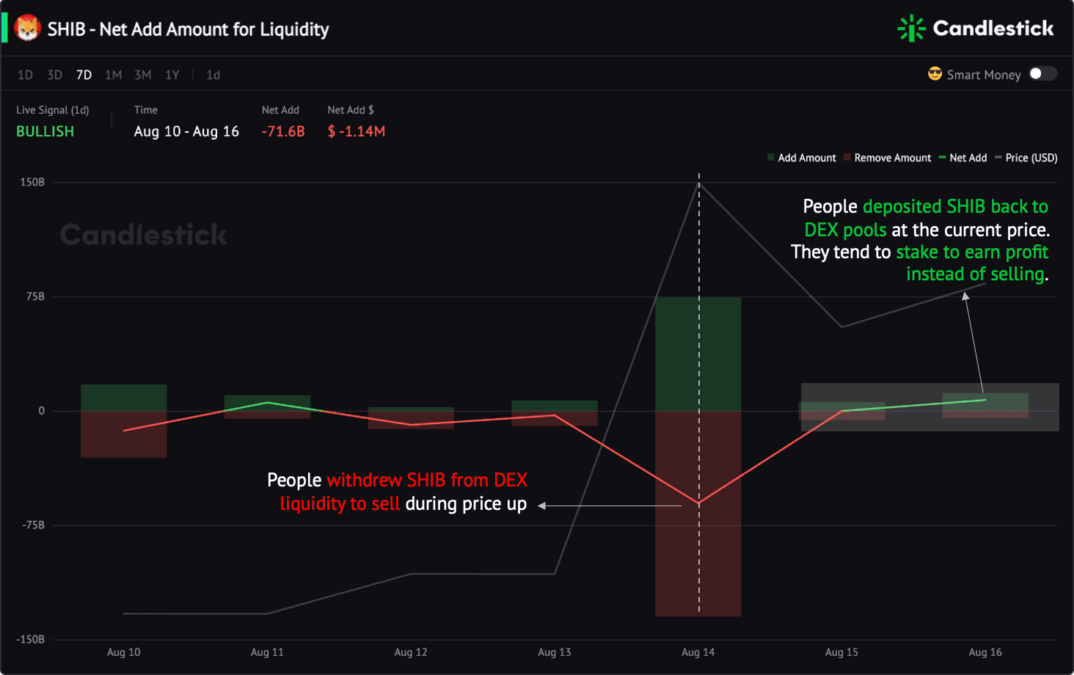

SHIB Net Add Liquidity: Changing from Large Removal to Positive Adds

When LPs put tokens to the trading pairs, they can earn trading fee interests. People will consider the profit of selling the tokens at the current price VS earning interests as an LP.

When unsatisfied with the current price or think it will go up, they tend to add the tokens to the DEX pairs to earn interest.

As shown on the above chart, SHIB Liquidity Net Add Amount dropped to its 7-day lowest on Aug 14 when the price soared. It indicates that people think it is more profitable to withdraw SHIB back to sell at a high price.

What Has Changed?

On Aug 15 & 16, when SHIB price dropped to $0.0001539, the Liquidity Net Add Amount started to turn positive. It indicates that people think it is more profitable to stake back the SHIB tokens to earn interest at the current price.

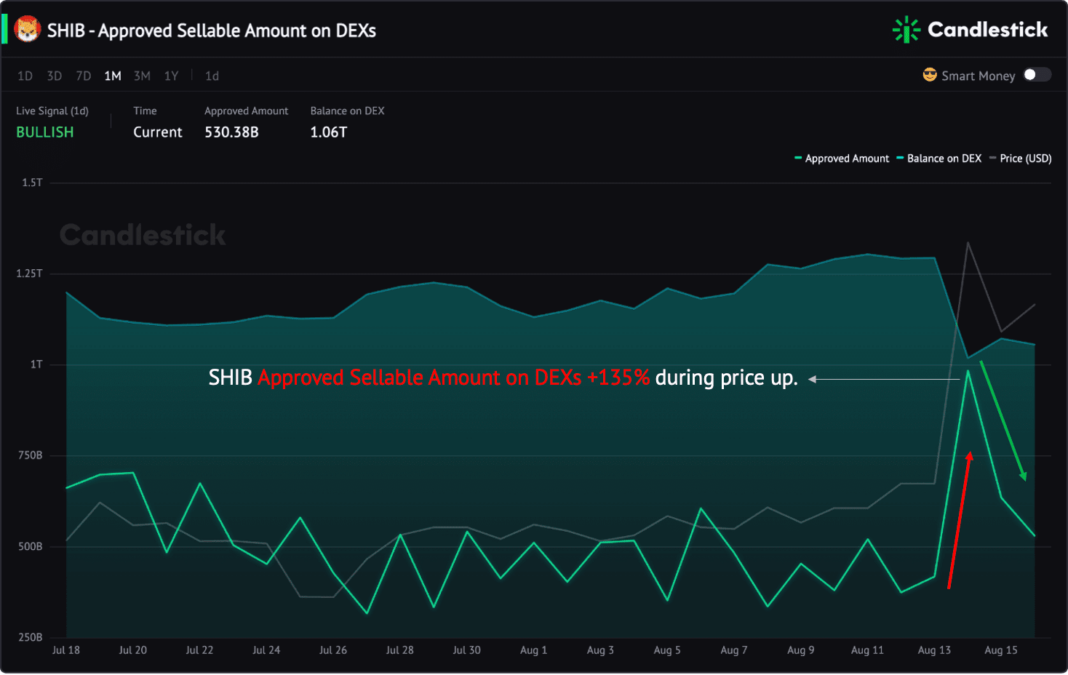

SHIB Approved Sellable Amount: Surged During Price Up and Dropped Now

The Approved Sellable Amount data is the total amount of tokens traders have approved on DEXs. Usually, it tends to stay relatively stable. Hence, when a sudden surge occurs, do notice yourself of the potential large sell orders.

We can see from the above chart that the SHIB Approved Sellable Amount on DEXs experienced a sudden surge during the price pump. Till now, it dropped back to a normal level.

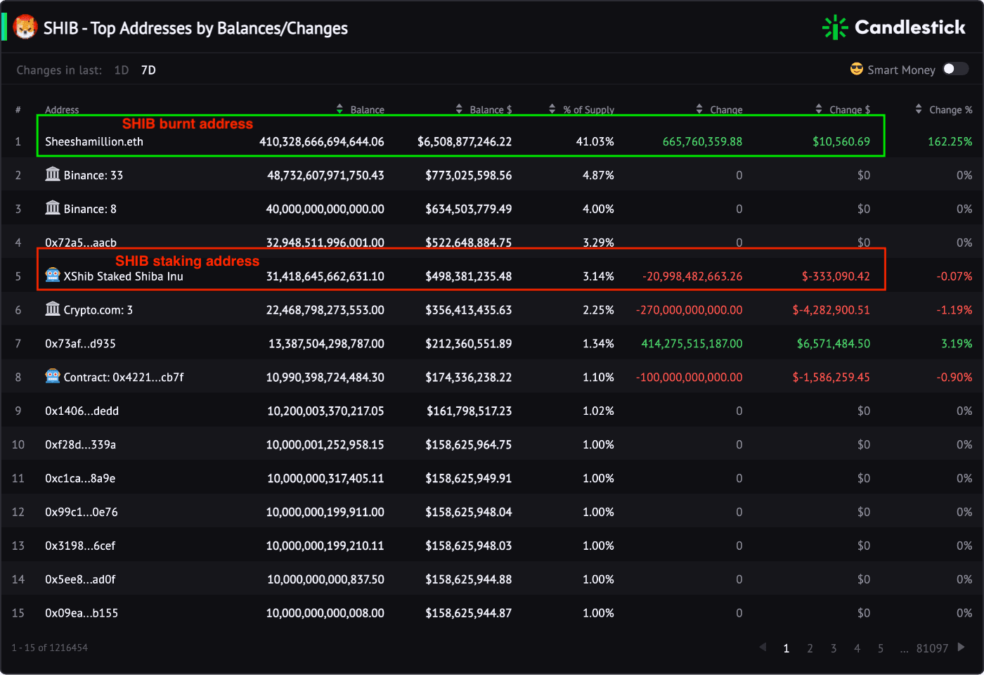

Last But Not Least, Do Keep Tracked of the SHIB Burnt Numbers

The first address Sheeshamillion.eth is SHIB burnt addresses. The amount of SHIB balance changes in this address is this amount of SHIB has been burnt in the past 1d & 7d. Hence, for this address, if you see green numbers changes, it is a bullish signal.

The No.5 address is the SHIB staking address. The balance changes indicates how many SHIB was added to stake or removed from staking. Hence, for this address, if you see red numbers changes, it is a bearish signal.

Combining these 2 numbers, then you can understand in the past 7 days or 1 day, if there are more SHIB coming to the market or less.