14% Supply Of MATIC Was Released? What Is The Whole Picture?

Today, a Tweet from a Blockworks researcher caught MATIC traders’ attention.

1.4 billion MATIC tokens (14% of the total supply) have been released from the vesting contract. Lots of holders are worrying about the dump.

News is true news. But it is not the whole picture.

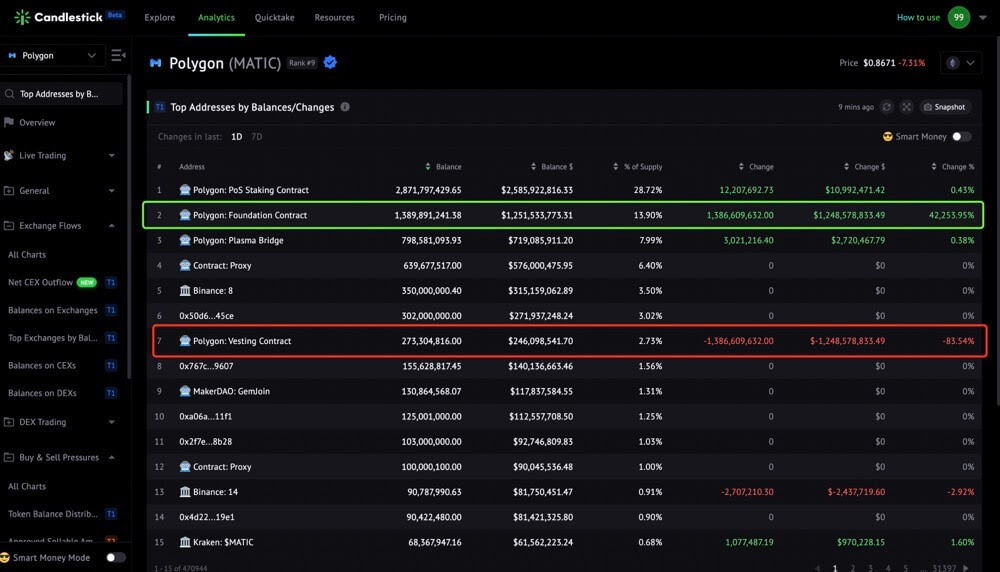

If we just look at one number, it can be misleading sometimes. We shared our story of 9x Badger investment on The Story of Building Candlestick. — The Badger token holder number dropped from 4k to 2k, a deadly signal for most people. But digging more into the LPs data, we found the unique number of addresses that provided liquidity was growing. It turns out the significant drop in holders was due to holders sending all tokens to DEX pools.

See the above pic. -1.4 billion MATIC tokens were removed from the Polygon Vesting Contract. And the same amount of MATIC tokens were added to the Polygon Foundation Contract.

These 1.4 billion released MATIC tokens were all transferred into the Polygon foundation contract right after! It is a bullish signal! The co-founders’ portions were re-staked!

If you dig more into the data, you should invest instead of sell. Candlestick covers 40+ metrics from DEX trading, liquidity movement, CEX flows, etc to empower your data trading analytics.

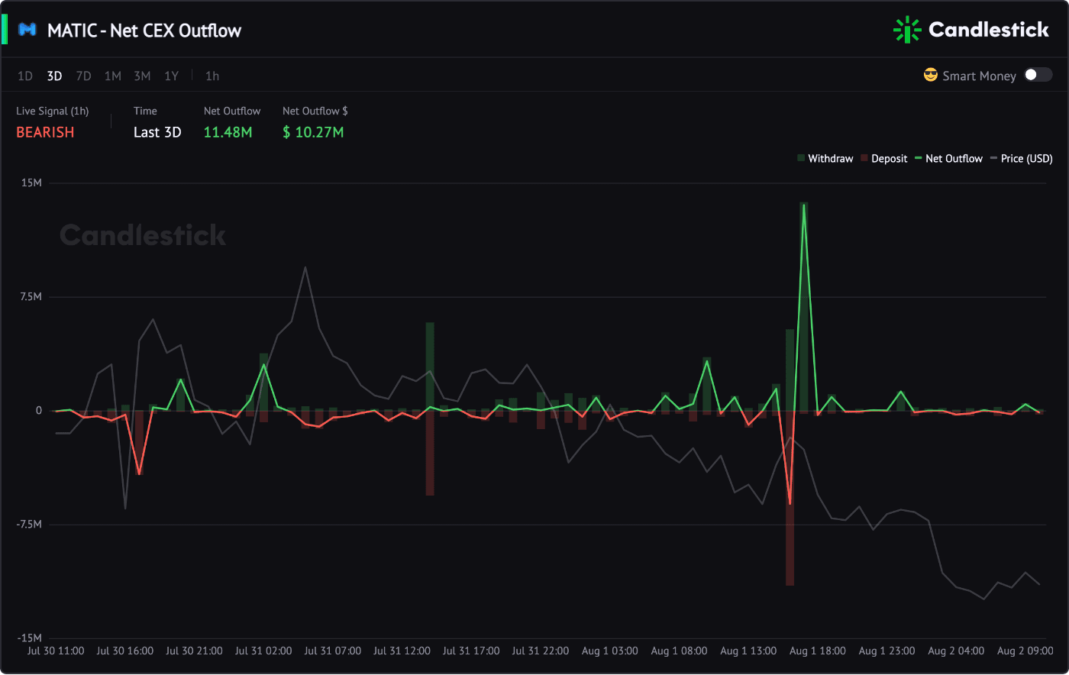

Let's check DEX trading, CEX Flow & Liquidity Data of MATIC

MATIC Net Buy Amount is positive 138.77K in the past 3 days. Net Buy Amount surges when the price is at $0.8971, $0.956 & $0.8947.

Positive Net CEX Flows in the past 3 days. CEX withdraw value > CEX deposit value.

CEX withdraws surge at price $0.923. Means holders transferred MATIC tokens back to their wallets to hold.

Liquidity movement is also positive in the past 3 days, recorded a net add amount of $288k MATIC added to DEX pools.